It was clear at the end of the 2024 January transfer window that Chelsea were miles off the PSR limit for the 23/24 season. They had time to repair the deficit with their year ending on 30 June. The only question was whether they would bother or if they would just wear the sanction.

We knew that on the face of their projected football numbers Chelsea were also millions off compliance for the 22/23 season that had gone before. Their accounts for the year to 30 June 2023 had not, by then, been released. We also knew that Chelsea had not been charged for any 22/23 breach unlike Nottingham Forest and Everton.

Hotels and car parks

The reason became apparent when Chelsea’s parent company and then Chelsea FC Holdings released their accounts in March 2024 revealing a restructuring of their “real estate portfolio.”

As we all now know, Chelsea had sold assets to “themselves” or more accurately, to their own parent/sister company and generated the profit required to pass 22/23 PSR. What didn’t change was the fact that the club remained well short for 23/24 PSR even if the hotel sale was ultimately approved.

The hotel sale was, indeed, approved by the Premier League over a year later in July 2024 with a £6m reduction in profit, apparently to adjust for broker fees that would have been payable had Chelsea actually sold the property on the open market.

Chelsea have decided that rather than adjusting their 22/23 numbers, they can simply recognise the adjustment as a loss in the 24/25 accounts. In effect, this moves £6m of loss into the current year protecting 22/23’s tenuous PSR position. It is likely that their 22/23 PSR position was so close to a breach that it could not take the £6m adjustment.

The Premier League are, it seems, fine with this sleight of hand.

There is a section of the latest accounts that Chelsea forgot to update which indicates that this change of plan came quite late in the day. Chelsea clearly originally believed it would need to adjust the 22/23 numbers:

As of now, we don’t yet know what has happened to the hotel revenue and profit since its transfer to Blueco 22 Properties. There is, somewhat surprisingly, no sign of any reduction of revenue in Chelsea Holdings’ latest results despite having lost the benefit of the £90m hotel business. Nor are there any payments from Blueco 22 Properties to the football club. For now, losing the £90m hotel business seems to have had no discernible impact on the club’s financials (except for the £70m profit on disposal).

Everything must go

Between the end of December 2023 and 30 June 2024, we now know Chelsea sold players to generate about another £104m of player trading profit to bring the 23/24 total to £152.5m.

However, plainly, this was still not enough and the club remained well short of 23/24 PSR compliance on 28 June 2024 and needed to “sell” or transfer non-men’s football assets in order to generate, at least paper, profits of around a further £75m.

It bears repeating that Chelsea were still significantly short of making the £105m 23/24 PSR cap even after:

selling players for profit of £62.8m in 2023;

selling players for profit of £152.5m in 2024;

selling hotels and a car park for profit of £76.5m in 2023;

recognising £30.6m of other income (essentially profit) relating to £17m of recharges from the parent, an unspecified £12.5m legal settlement and £1m of tax credits in 2023; and

receiving the dubious, associated party, one year Infinite Athlete sponsorship in 23/24 for £40-50m.

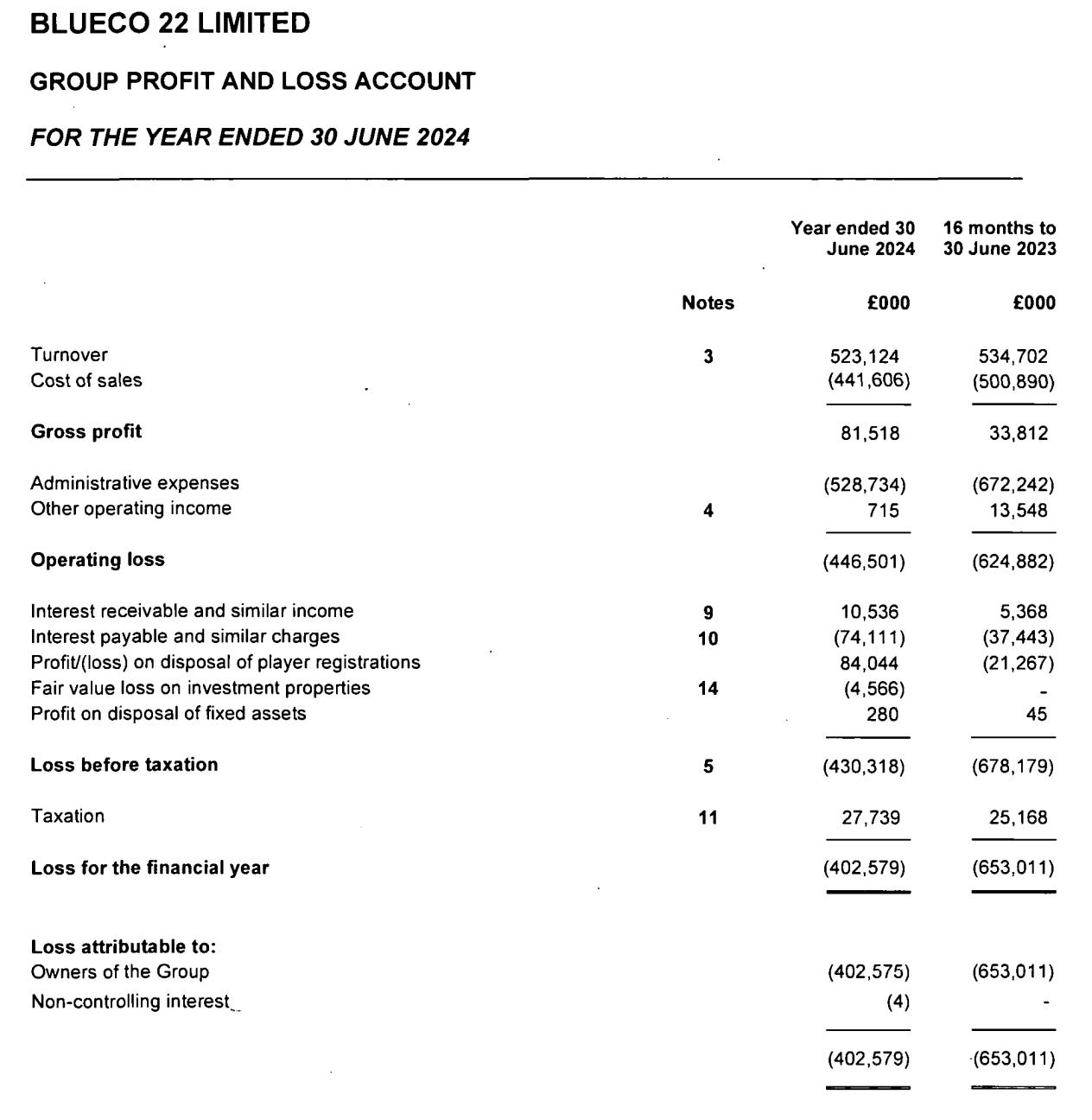

That is the scale of Chelsea’s operating losses (ie before player profits, other asset sales, interest and tax) - such losses are now over £900m in the last 5 years. And the current year losses are likely to exceed £200m again even after the Club World Cup participation fees.

Burning cash

Whilst the viability of Chelsea is not in doubt as long as the ownership group continues to put their money where their mouth is with equity investments, such spending is not considered sustainable by most observers. The latest such subscription was for £115m and completed before 31 March - it is explained here.

Blueco 22, Chelsea’s parent, has now lost over a billion pounds in just 28 months. Even City Football Group hasn’t managed that in 11 years. These are staggering losses on any basis.

Nothing to see here

Sales of property to one’s own owners or subsidiaries have been outlawed by UEFA and the EFL for years. Somehow, the Premier League clubs, whilst apparently obsessed with ensuring the stability of the game and PSR compliance, have maintained a blind spot for such transactions.

On 6 June 2024, the Premier League put a proposal to clubs to exclude the sale of tangible and other assets from PSR calculations. We don’t know what the drafting looked like but it apparently interfered with clubs’ generating ancillary revenue from assets like hotels and other entertainment on club property. This led to the proposal being narrowly rejected, receiving only 11 of the 14 votes necessary. A tightened proposal has never returned for a vote.

To suggest the drafting is difficult is hard to comprehend. Both UEFA (which now almost half the Premier League have to comply with anyway) and the EFL (which another 3-5 teams are always mindful of) exclude the proceeds of such disposals. The EFL drafting if not perfect for the Premier League could be easily extended if necessary. At very least, it is a strong and workable starting point.

It was then no surprise that on the day after the Premier League vote, on 7 June 2024, it became apparent (at least to me) that Chelsea’s open confidence of meeting 23/24 PSR was not down to uncertain player disposals in the June window, but down to matters they could fully control - more massive internal sales.

Honestly, it is not about PSR, it is about heralding a new era

On 29 May 2024, Chelsea had announced "In advance of next season, Chelsea Women will be repositioned so that it sits alongside, rather than beneath, the men’s team in a move that heralds a new era for the club." Chelsea also announced: "Currently, any prospective investor into a WSL team is required to invest through a men’s team...BDT & MSD Partners, a global merchant bank, has been engaged as financial advisor on a potential minority investment in the club, inclusive of evaluating inbound interest related to Chelsea Women."

At that time, Chelsea Football Club Women Limited (CWL) was still within the Chelsea Holdings group. But what if it moved out of Chelsea FC Holdings and into, say, Blueco 22 Midco to "sit[..] alongside, rather than beneath, the men’s team." Such an internal "sale" would appear to crystallise a substantial one-off paper profit for Chelsea Holdings which could, it seems, be applied in 2023/24 to largely wipe out the current 23/24 PSR deficit.

This investment "opportunity" was reported to be capable of delivering a third party minority investment at an enterprise valuation of $200m (around £160m).

A small, heavily loss-making business or revenue doubling every 2 years?

We now know what CWL’s financials looked like in 23/24. Record revenue of £11m but record losses of £8.7m - can you see a trend here? Unlike men’s football, there is no material market to trade players for profits that are substantial enough to outweigh operating losses. CWL have generated less than £500k of player trading profit in the last 3 years (Men’s: £338.6m) - so just the 700x multiple!

As ever, Swiss Ramble has written the definitive article on the value of women’s teams here so I won’t repeat his analysis. Suffice it to say a 17.4x revenue multiple in the absence of being able to ascribe any profit multiple is a ridiculous valuation. Yes, we all know about the Angel City franchise bought by Disney billionaire and CEO Bob Iger and his wife for $250m. But that is also not the real world. Angel City is more a high-profile entertainment venture than a sustainable football business.

According to Deloitte, the whole of the top 15 of the European women’s game generated revenues for the year to 30 June 2024 of around £100m. CWL is simply not worth almost 2x the revenue of the entire European game.

Let’s plump for £200m

On the eve of the financial year end, after a fraught internal negotiation between Chelsea Holdings and Blueco 22 Midco (!), the parties struck a deal at £200m to sell CWL. There is some question as to whether reference in the accounts to 28 July 2024 is a typo or the deal actually took place in the 24/25 financial year but regardless, accountants inform me that it would be acceptable as an adjusting post balance sheet event or considered insufficiently material to restate the 22/23 number.

Chelsea have also confirmed that 9 months after the transaction, the Premier League is still assessing the fair market value. Presumably, Chelsea’s position is that, like the £6m hotel adjustment, any reduction in value can simply be recorded in the financial year in which the final declaration is confirmed. This would potentially be another clever way to move substantial losses from one year to another. It may even move millions of pounds from PSR to a new financial fair play regime such as squad cost control.

What’s good for the Chelsea is good for the Villa

Unsurprisingly, it has taken just hours for Villa to confirm they will also consider selling their loss making women’s team to fix their ongoing PSR issues. Why wouldn’t they. If the argument is that the appropriate revenue multiple is 17x not due to today’s financial performance but because of the future opportunity, then Villa is similarly well placed to Chelsea.

Perhaps Villa have more opportunity. According to the bull case, we are in the very early days of women’s football’s commercial success and growth. Maybe Villa should be valued at 20x revenue of £6m. Maybe 30x. Perhaps all the big brands in the men’s game have a women’s team worth as much as Angel City’s $250m? Who can say?

UEFA breaches confirmed

In Chelsea’s accounts they disclosed this slightly convoluted explanation of UEFA compliance. In short, they are saying they have failed UEFA financial fair play rules and there are ongoing discussions about consequences and the scale of the breach.

This is not a surprise. We have always known that both the hotel and CWL sales would not be accepted by UEFA. Furthermore, it is possible other adjustments have been required but unlike some clubs (eg Newcastle), Chelsea has not disclosed any such differences.

The Times have now confirmed the breach. The outcome of the settlement discussions is said to be due to be made public by Uefa in mid-May. The breach for 24/25 will be subject to a fine but Chelsea will be negotiating with UEFA in the knowledge and expectation of both qualifying for Europe and breaching again in 25/26.

It is worth noting that not only do UEFA not accept these asset sales, they have also taken an axe to their operating numbers. We know from UEFA’s Landscape Report that the clubs submit adjusted financials. For some clubs these numbers show material differences from the published numbers. Unsurprisingly, Chelsea are one of those clubs.

The report details “operating profits” which is the equivalent of a club’s reported EBITDA (earnings or losses before interest, tax, depreciation and amortisation and before asset and player trading profits). For Chelsea, these numbers have been materially adjusted downwards from a reported loss before interest, tax, depreciation and amortisation of £7.7m for 2024 and EBITDA of £23.1m for 2023 to a loss of £50m for 2024 and a loss £25m for 2023. So, by UEFA’s numbers, 2024 is £42.3m worse and 2023 is around £48m worse. Taken together in the relevant calculations this is a £90m adverse swing.

The weaknesses of the PSR have been fatally exposed

Since the very early days of Chelsea’s supercharged spending under the Clearlake/Boehly ownership, the PSR issues have been apparent. Moreover, the PSR avoidance has been obvious. Whether it would turn out to be evasion was to be seen. As each shareholder meeting has come and gone without clarificatory rule changes, it has become clear that Chelsea were being permitted to ignore PSR even whilst other clubs lost points, swapped players and parked investment plans.

Chelsea have killed PSR in plain sight and only the Premier League are to blame.

Wonderfully clear explanation. Well done.

Fantastic writing. So if Mr Masters and the current PL board are removed post the 115 outcome (or the external football regulator established) this may be bad for Chelsea? Presumably there is scope for revisiting this sleight of hand?