REVEALED: The clubs at risk of 24/25 PSR and UEFA FFP issues (POST SEASON UPDATE)

30 June deadline day scrambles are not yet a thing of the past

Preparations are underway for the first transfer deadline of the Summer window - the much maligned 30 June accounting year end. Whilst Jim White has not yet pulled on the yellow tie for the half way point of the year, it is clear that 30 June will remain a key date for many clubs until PSR is finally consigned to history.

The recent publication of the 23/24 accounts for all Premier League clubs revealed just how close many were to a breach of 23/24 PSR were it not for the frantic scramble at the financial year end. For some, like Villa and Chelsea, it confirmed their breaches of UEFA FFP in at least one respect and pointed to likely compliance failures for 25/26 for those new UEFA qualifiers like Newcastle and Nottingham Forest.

The first indication of clubs with PSR issues comes when they move their long held year end - usually from 31 May to 30 June. This administrative change under section 392 of the Companies Act 2006 is often said to be “housekeeping”. Except it rarely is.

In 2023, Leicester City moved their year end to 30 June 2023 as it was entitled to do. In doing so, it successfully moved itself outside of the Premier League’s jurisdiction for 22/23 PSR. That decision is still being challenged at appeal by the Premier League.

In 2024, Aston Villa also moved their year end to 30 June buying themselves an extra month of the transfer window to address their substantial PSR deficit.

Early this year, Wolves moved their year end to 30 June in another pointer to the need for potential PSR profits before the year end.

Only Arsenal, Liverpool and West Ham now maintain a 31 May year end. None of those clubs have any PSR or UEFA FFP need to move the accounting reference date.

Who is at risk?

As PSR is a 3 year rolling test, the simplest place to start in assessing who may be close for the current season are those that told us (either expressly or by conduct) they were for 23/24:

Aston Villa

Chelsea (UEFA only (not PSR due to non-mens football asset sales))

Everton (PSR only)

Leeds United (PSR only)

Leicester City (PSR only)

Manchester United

Nottingham Forest

Newcastle United

Added to this list of teams that could be close in theory are Wolves due to them putting their head above the parapet with the year end move. Wolves are probably the easiest to remove from the watchlist too.

Wolves - no 24/25 issue

The move to 30 June increasingly appears closely related to a potential PSR challenge but also to the fix - the Summer disposal of Matheus Cunha. On 1 June 2025, the player signed for Manchester United with his £62.5m release clause triggering a meaningful trading profit of, perhaps, £30m-35m after costs. And with that, Wolves will not be burning the midnight oil on 30 June.

So, what of the others. Again, lets take the easy ones first and work through the rest.

Chelsea - no 24/25 PSR issue, UEFA fail

Chelsea will lose over £200m at the operating line again this year and will continue to need owner equity investment to pay the bills. There is no sign that either this will stop or that their continued player investment will. Ordinarily, a club losing this much annually and with a still bloated squad of costly failed signings would be in both financial and PSR trouble. But Chelsea are different. PSR is dealt with by the ongoing Women’s sale valuation and the earlier hotel sales before it. Beyond that last year’s £152m of player trading profit was exceptional.

The Premier League will now approve the Women’s sale valuation following the minority investment by Alexis Ohanian, tech entrepreneur and founder of Seven Seven Six at a pre-money valuation in excess of £200m.

Financially, Chelsea do not seem to care even with the likely return of the high earning (and with substantial remaining book value) Raheem Sterling, Ben Chilwell, Kepa Arrizabalaga and João Félix. Axel Disasi, Lesley Ugochukwu, Carney Chukwuemeka and Armando Broja are also all likely to return from loan but will be less of a re-sale/re-loan concern. As for Mykhailo Mudryk, he is simply an uncrystalised loss/impairment accounting judgement, albeit a big one.

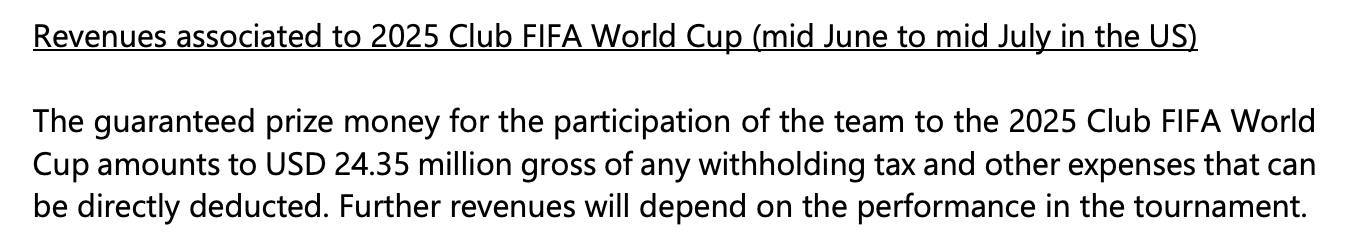

Two other elements, which are interconnected, will be key financially: Champions League qualification (now a minimum 25/26 revenue boost of £70-80m before matchday revenue and sponsorship uplifts) and a proper front of shirt sponsorship. In addition, Inter Milan have formally confirmed (see below) their minimum participation Club World Cup fees are $24.4m so Chelsea are likely to generate more again.

On UEFA FFP, Chelsea appears relaxed about their ongoing breaches and will, by next season, in all likelihood, be part of a phased settlement agreement. This is essentially a “special measures” regime with bespoke limits that apply only for UEFA competitions. Chelsea have already tacitly admitted that they see this as an acceptable cost of the rebuild.

Aston Villa - possible 24/25 PSR issue, UEFA fail

The other club covered in my recent piece on UEFA breaches were Aston Villa. From their own statements, it appears Villa will be close to a PSR breach for 24/25 too. Certainly, they have floated an internal sale of the Women’s team if it is necessary and, presumably, the higher the approved Chelsea value, the more attractive this becomes. It won’t work for UEFA as we know but, like Chelsea, Villa are already likely planning for life under a UEFA settlement regime which will cover UEFA breaches for 24/25 and the next couple of seasons too.

The extent of their potential breaches is unclear. The Quarter Final stage exit of the Champions League would have been extremely lucrative both in prize money and match day revenue. Total additional revenue would likely have reached €100m. However, costs would also have been materially higher. Some player wages would have had Champions League uplifts, bonuses will have been substantial and the January loan investments in Alex Disasi, Marco Asensio, Marcus Rashford and Donyell Malen were significant. And, of course, failure to make the Champions League will probably mean a drop of £70m+ compared to a Champions League season.

Villa have proved adept and inventive at trading in recent windows and the €77M + €13m Duran sale was a coup. So it is very likely they will find a way but they should not expect a quiet June and will be working on the assumption that UEFA FFP is already breached.

Newcastle - no 24/25 PSR issue

Even after banking a c£20m+ profit on the sales of Miguel Almiron and Lloyd Kelly, Newcastle’s super quiet January was telling. There was obviously very little appetite to be scrambling around at the end of June negotiating multiple sales, swaps and last minute compromises with Manchester United (on Dan Ashworth) just to hit the £105m cap.

So, we can assume that Newcastle are on course to be broadly under the PSR cap - the precise position will depend on the balance between the final league position merit award (around £165m including facility fees) and the cost of bonuses triggered by the Carabao Cup win and Champions League qualification.

Depending on whether the Champions League qualification bonuses have conditions making them payable in 2025/26 (such as being named in the Champions League squad) or whether they will be recognised as a 2024/25 cost, it would not be a major surprise if a small amount of player trading was still required before 30 June either way. The club itself have briefed local journalists that they have no 24/25 PSR issue even after such bonuses.

PSR aside and looking forward, Newcastle will also be concerned about UEFA FFP and their UEFA forecast will need to incorporate the substantial downward adjustments they declared in their accounts (see below). Significantly, the biggest element of the adjustment - transfer profits - will apply to and impact both the football earnings and the squad cost control tests for UEFA.

Given those adjustments increase the operating losses by around €50m, it is hard to see how Newcastle would not breach the UEFA football earnings test for 25/26. Newcastle will watch with interest as to how UEFA deal with Chelsea and Villa for breaches to that test in 24/25. That news is expected soon.

It is harder to estimate the precise position under the squad cost control element as this is a calendar year test (ie to 31 December 2025) but the UEFA adjustments will hurt Newcastle here too. It may be close but Newcastle will prepare to breach the 70% cap and will take a financial penalty for this element of FFP. It may also be wrapped up into an overarching settlement. Again, the Villa and Chelsea situations will provide a good insight into UEFA’s approach to breaches of multiple branches of FFP.

Manchester United - no 24/25 PSR or UEFA issue

Aside from Manchester United’s UEFA breach in 2023 for which they paid a small fine (€300,000), United have always proclaimed their compliance with all PSR and FFP. We do know that the PSR element of that compliance was only after substantial allowances for Covid and, potentially, the non cash impacts of currency movements. Ironically, those same currency movements will flatter United’s Q1 results to 31 March when they are released on 6 June.

In reality, United remain broadly in line with their budget despite a terrible league season. As of 19 February 2025, United were guiding:

Any sensible board would have been conservative on that guidance so you can assume that the worse than expected league performance has been compensated by other upsides.

The Europa League did not save the season on or off the pitch although it did generate close to £30m even before matchday revenue from seven home Europa fixtures. In the Premier League, United generated £140m from merit and facility payments (28 games were televised - more than everyone but Liverpool and Arsenal). However, this was around £17m down on 2023/24 and, perhaps, £30m below budget. So it is no surprise that they reluctantly agreed to a post season tour to Malaysia and Hong Kong to compensate for the loss of 2-3 league places.

Meeting that NYSE guidance is likely to put United safely inside the £105m cap. Even a collapse of the Jadon Sancho deal is unlikely to scupper that. On the contrary, Sancho is probably a loss making disposal so, if returned, with an accompanying £5m break fee, this could actually be a positive for 24/25 PSR. It is unlikely United would rely on the sale of Marcus Rashford before 30 June for PSR compliance either. As Antony is a) very unlikely to go to Real Betis b) is, at very best, neutral for PSR, you can probably disregard him as well. Likewise Casemiro is a sale that is about cost mitigation going forward not PSR profit in 24/25.

Manchester United are another club who are at risk of failing the UEFA football earnings test. But it is unlikely they would take any risks when making this statement on 19 February 2025:

So somehow, with add-ons and unconfirmed allowances, United are probably fine for 24/25 PSR and UEFA FFP. 25/26 UEFA FFP may well be irrelevant given the only realistic route now is via a Europa League win. Without that trophy, United are not even going to be in the Europa Conference. I would expect the club to be broadly compliant with all UEFA tests in 25/26 if they did win the Europa League and qualify for the Champions League.

PSR, however, will undoubtedly be a challenge with no Europe at all in 25/26. Sir Jim Ratcliffe may well be looking at the sale of the Women’s team.

Nottingham Forest - no 24/25 PSR issue

Forest have achieved one of the biggest jumps in domestic broadcast revenue between two seasons following the rise from 17th to 7th. This will be worth around £30m more than 23/24 and a total of around £157m of broadcast revenue. Whilst there will also be uplifts in matchday and commercial revenue, it is likely that costs will also have risen this season and there may have been bonuses payable for European qualification (albeit the Europa Conference is not particularly lucrative after costs). Taken together, Forest are likely to be well clear of a PSR issue for the current season with 22/23 falling away and the club having the full £105m cap.

UEFA FFP could well be a challenge next season - wages have been running at more than 95% of underlying revenue (ie revenue excluding loan fees) for the last two years. In addition, some of the £100m of 23/24 player trading profit will be discounted for the same reasons as Newcastle which will affect both the football earnings and the squad cost control calculations.

Everton - no 24/25 PSR issue

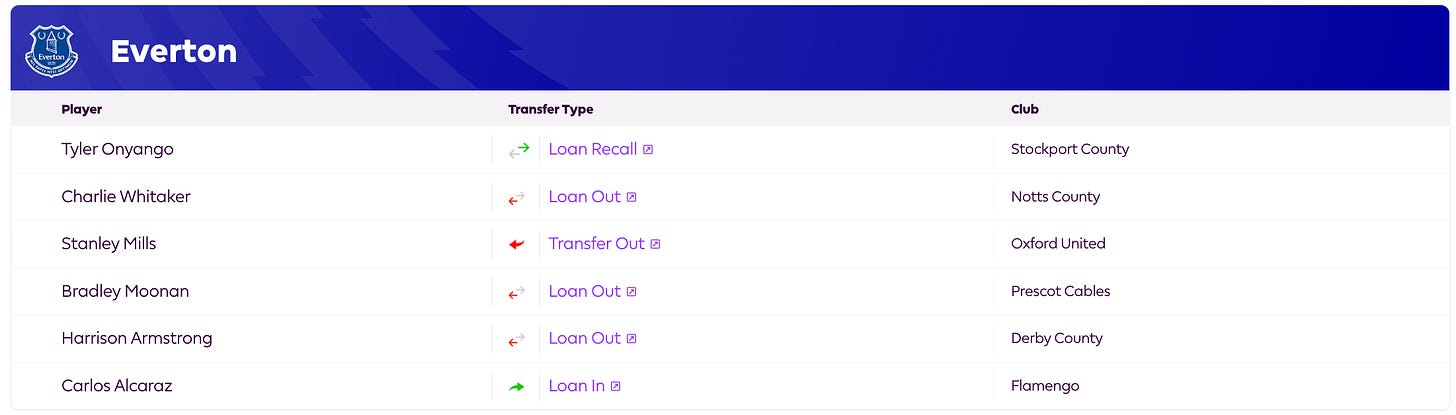

Everton’s lack of transfer business in January was, as with Newcastle, telling.

With little leeway in 24/25 and three wins during the January window, Everton clearly took the view that they should keep their powder dry for a calmer post 30 June rebuild. Added to the higher finish this season (probably), Everton’s recruitment team will be on holiday in June.

Leeds - no 24/25 PSR issue

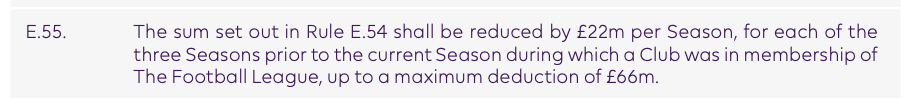

Leeds appeared to have a challenge for Premier League PSR compliance largely because their cap upon return is just £61m (£35m + £13m +13m).

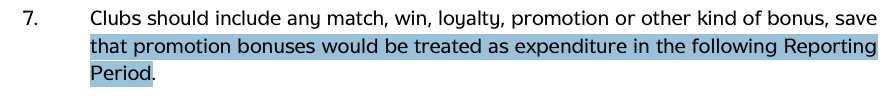

Leeds have sold well to comply in the 2 years in the Championship and they will have to deal with a material hit of the £19.25m of promotion bonuses payable for this season’s success.

We know from the Nottingham Forest PSR case that promotion bonuses are neither valid deductions for PSR nor mitigation for a breach.

However, Ipswich recently explained that the promotion bonus was excluded from its 23/24 PSR calculation.

You can see that for 23/24 PSR, Ipswich were permitted to add back £16.3m of costs on top of the standard allowances which included £15.6m of promotion bonuses.

We know this because the “loss per financial statements” was actually £39.3m in the accounts and not £23.0m. This £16.3m will be applied in 25/26 when Leeds have a full £35m annual allowance. This is because the Premier League conform with the EFL rule that allows the promotion bonus to be treated as expenditure in the year after promotion.

It does appear that the profitable Archie Gray sale has been put into 24/25 (though Spurs recognised the purchase in 23/24) so when added to the sales of Georginio Rutter and Crysencio Summerville, Leeds will have a hefty player trading profit to offset the inevitable operating loss.

In short, Leeds may still be busy this June and, in another complexity, will need to address any issue without CEO, Angus Kinnear who joined Everton in May. Without the burden of near £20m promotion costs in 24/25, Leeds will likely find a way to comply. The problem is, however, pushed out into 25/26 as it was with Nottingham Forest in 22/23.

Leicester - who knows!

Leicester somehow avoided breaches for 22/23 but have now been charged in respect of 23/24 following the publication of the results of Premier League’s arbitration against them. We know that the case is now being pursued by the Premier League for breaches of the £83m limit in the EFL in 23/24 with punishment likely to be meted out in the EFL in 25/26.

This is how Leicester dealt with their ongoing battles in their recent accounts:

Any doubts as to how the PSR rules apply to relegated and promoted clubs going forward have been dealt with by a raft of changes to the Premier League rules that all appear to have been prompted by the Leicester case.

Reports have suggested a breach of more than £17m for 23/24 and a possible 12 point deduction pursuant to the EFL sanction guidelines. Personally, I think it is unlikely that the EFL rules will apply - it is, we are told a Premier League Independent Commission and, therefore, to be pursued pursuant to the Premier League rules. The EFL will be a benchmark but not binding on the IC. Where the deduction lands is likely dependent on the quality of the lawyers’ submissions.

In Premier League (as opposed to EFL) terms (ie based on Forest and Everton), a breach of £17m without mitigation and before Leicester's other charges, the sanction appears to be a 5-6 point deduction. The difference here is that Leicester’s breach was of a £83m upper limit - so a higher percentage miss - and it is not obvious what mitigation the club can point to. This is how the Everton FY23 IC explained it’s approach to a near £17m miss:

For now, unless cost control was exceptional this season, it is most likely that Leicester will look to make a sale in June or, alternatively, engage Nick de Marco KC to come up with another lacuna to avoid a further charge for 2024/25.

Shock therapy has worked

The shock therapy of PSR points deductions continues to focus the minds of those clubs at risk of breaching. The acceptance of Chelsea’s radical “solutions” by the Premier League gives most clubs a ripcord if things go wrong with more conventional routes like selling players. So, we should expect no clubs to fail Premier League 24/25 PSR when the formal announcement is made next January. Leicester may have to deal with the EFL, who will be excited to receive them back into their remit.

UEFA’s more stringent (or just more sensible) rules will likely mean all of Aston Villa, Chelsea, Nottingham Forest and Newcastle United will breach in the next round of tests. The leniency of the sanction, however, means that those rules are no longer an effective deterrent. Each club will take the view that in order to get into European competition it will have been a breach and a fine worth taking.

There is some risk of an unexpected surprise if UEFA hit Chelsea and Villa harder than expected for 24/25 breaches but, for now, severe sanctions are the exclusive preserve of the Premier League.

That strength appears to have done its job.